The basic of banking haven't changed for 600 years, but there's still tremendous nuance in what they actually do and don't do.

Hey friends -

Why do we even have banks?

They are antiquated at first glance. They're slow to change, the customer service can be horrendous, and they have a tendency to blow up from time to time and cause tremendous collateral damage. Yet we still have almost 5000 banks in the US alone, a number that was almost three times greater just 30 years ago.

Despite the trend line, banks are here to stay. As Michael Dowling explained on our recent Funders & Founders episode:

PayPal looks and acts like a bank for everybody. But they're not a bank. PayPal is storing that money somewhere. Behind challenger banks, like Chime and Mercury, behind PayPal, behind Venmo... behind all of these things, are banks. Banks act as the core regulatory and operational infrastructure for managing value.

But why, what's so special about a bank? WTF is a bank anyhow?

In this week's letter:

Banking: a brief and incomplete history of banking, divergent regulatory regimes, and the impact of digital

Why pepperoni curls, lessons from launching a global satellite network in 1994, and more cocktail talk

A Dirty Daiquiri’s the perfect summertime drink when you’re traveling and short on ingredients

Total read time: 15 minutes, 53 seconds.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans (thank you Wikipedia).

In more colloquial terms, a bank is an institution:

Where people and companies can store money,

That will return the stored money promptly when requested, and

That makes loans to other, often unrelated parties.

Banks function as middlemen - borrowing from depositors and lending to borrowers. They make money on the spread between the rates at which they borrow and the rates at which they lend plus any associated transactional fees they may charge for those activities.

Such a simple framing doesn't really explain how we go to where we are today. Before 2008, Goldman Sachs was called a bank but neither took deposits nor made loans in a traditional sense. During the Great Financial Crisis, Goldman Sachs did in fact get a federal charter and became bank. Something changed.

Banks used to issue their own private money, but we've now replaced it with government-issued banknotes. Our bank definition covers just two activities - borrowing and lending - yet there are roughly 60 bank regulators in the US.

These anomalies don’t make a lot of sense by themselves. Historical context helps.

Banking in a modern sense dates to 1400s Italy when the Medici and Fugger families reigned supreme.1 Much of their activity would be familiar to anyone who banks today.

Bank capital started with funds put up by the bank partners themselves. Profits were shared by the partners in good years and losses in bad ones. Additional funds were gathered from the public as demand deposits that could be withdrawn at any time and time deposits that could not be withdrawn until some specified point in the future, often three months or more. Funds were primarily used to finance trade.

Trade in the 1400s meant time, distance, and risk. Imagine a Florentine merchant traveling to London. The merchant first needed a florin-denominated loan to purchase goods in Florence before they could travel the roughly three months to London to sell those goods for pennies before returning to Florence to pay back the loan. Exchange rate and death are among the risks involved.

A single bank with locations in both Florence and London - or a partnership of banks - could help the merchant along the way. The Florentine branch could make the initial loan - collateralized by the merchant's wealth - and issue a bill of exchange that allowed the merchant to deposit florins in Florence and withdraw pennies in London.

When the merchant arrived in London, they could redeem the bill of exchange with the London branch at whatever was the then prevailing exchange rate in London. The better-informed bank often made a profit on the bill - whereas the rate may have been 10 florins to the penny three months earlier in Florence, the rate may be 20 florins to the penny in London when the merchant arrives. A merchant who deposited 100 florins expecting 10 pennies may in fact only collect 5. The bank makes a profit of 10 florins per penny, a payment that compensates the bank for storing value, transporting it to far-flung locations, and handling the exchange rate.

The merchant is likely to use some of the proceeds to buy more goods in London that can be sold back in Florence. A similar, mirrored bill of exchange happens on the leg back home. Once the merchant arrives in Florence and the London goods are sold, the merchant pays back the original loan. The Florence branch collects a similar profit on a bill of exchange and interest on the loan.

Buried in this merchant-bank relationship is the beginnings of risk management - the bills of exchange and loan have different risk profiles. If the merchant is killed or their goods are stolen, the bank loses money on the loan but not on the bill of exchange. If the exchange rate moves against the bank, the bank loses money on the bill of exchange but de-risks the loan - their loss is the merchant's gain, increasing the likelihood that the loan will be paid back.

The basics here are not all that different from how a bank would fund a farmer in the midwest today. A bank may provide deposit services to allow the farmer to keep their money safe and lend money to help them purchase grain. If the farmer is purchasing fertilizer from Canada, the bank may also handle the USD-CAD exchange.

Where today's banks start to diverge from the past are in their legal and regulatory structures. At the time of the Medici family, the modern structures of a business didn't yet exist and charging interest was still banned by the catholic church. Yet the flow of funds and how they were used were already very much familiar.

But another crucial innovation awaited before legal and regulatory innovations would follow. The world first needed banknotes and fractional reserves, inventions that first appeared at scale in 1600s London.

Goldsmiths in London were not the first to discover the attractiveness of banknotes and fractional reserves, but it's nonetheless the resulting popularity from their implementation that gives rise to their use today.

London goldsmiths stored money in secured vaults on behalf of customers. In time, each customer's claim on deposits evolved from being a claim on their specific deposit to a claim on an equivalent sum. Money is fungible so a customer shouldn't care which dollars or pounds they receive back.

As fungibility developed on the goldsmith's end, so too did tradability on the customer's end. The claims on deposits became exchangeable - whoever held the claim could redeem it for money deposited. It's a commercial banknote by another name - a piece of paper, issued by a private company, that promises a sum of money when redeemed.

Not all of the banknotes were likely to be redeemed at any one time, which allowed the goldsmiths to put otherwise idle money to good use - it was lent out for interest. In contrast to the banknotes which could be redeemed on demand, the loans were paid back over time. That meant there was only ever a fraction of the banknote capital available, the rest was lent out. Fractional reserve banking was born.

The newly popularized banknote and fractional reserve banking, combined with the core deposit and loan making already familiar in the Medici era, forms the basis for most banking. We in the US imported the model with the first commercial bank, the Bank of North America, in 1782. It was a robust enough model to fuel multiple eras of Free Banking across Scotland, the United States, Canada, Sweden, Switzerland, and Chile throughout the 1800s.

Free Banking is a misnomer and its history has been misrepresented. More accurately called "lightly regulated banking," it's banking characterized by light regulatory touch, and generally free competition and exit. This is an era before government issued national banknotes - commercial banknotes and deposits were denominated in and redeemable for silver or gold coins.

History's been rewritten by the winners to tell stories of how risky free banking was and why we're better off today with heavily regulated institutions that rely on government-insured deposits. Reality is more complex.

Most of the banks of the era were sound. Notes issued by unsound banks traded at a discount. Regular publications like Thompson's Bank Note Reporter widely disseminated information on the soundness of institutions. Clearinghouses served to swap banknotes from distant banks for ones closer to home. In short, free banking created was relatively successful at facilitating financing and creating sound money.

Why did it end? Government. As economic historian Charles Kindleberger stated, there's a “strong revealed preference in history for a sole issuer." Said more explicitly by Selgin and White:

[T]he preference that history reveals is that of the fiscal authorities, not of money users.

The government took over printing money because it's profitable to do so. History was rewritten to vilify free banking and promote the heavily-regulated, government-insured version instead.

It's a story that fills many books. For us here, its relevance is as the last leg of modern banking, starting in the US with the National Banking Act of 1864. Banks now trafficked in government-issued banknotes and were governed by an increasingly heavyweight system of laws and regulations.

Borrowing from depositors, lending to borrowers, doing so with fractional reserves, powered by government-issued banknotes, and governed by a heavyweight system of laws and regulations. Almost 500 years after the Medici family, modern banking was born.

Modern banking is regulations that both govern what a bank can do and prohibits non-banks from doing the same.

It starts with a charter - banks exist as government-chartered entities. A charter isn't a carte-blanche to do anything, but rather a detailing of the types of activities the bank will engage in and government approval for those specified activities. It's the beginning of many restrictions placed on banks as to what they can and cannot do, who they must and cannot lend to, and how much debt they can take on relative to the equity on their balance sheets.

Charters are the reason I cringe when I hear people talk about "crypto banks." No sane regulator would permit a bank to stake its entire business on the success or failure of a single industry, crypto or otherwise. Embedded in a charter, and enforced by regulatory oversight, is a bank's commitment to reasonably manage risk including diversifying the types of clients it serves.

A bank tolerates a multitude of regulations because of the profit upside offered by activities that only banks can perform. Only banks can offer government-guaranteed deposits to the public, FDIC-insured in the US. That's an exceptionally cheap cost of funding against which banks can make loans, cheap enough that it allows them to out-compete other lenders.

In the US, banks also have exclusive access to Fedwire, the interbank payment network. Non-banks are forced to go through banks to move money, a service for which they charge. Not only is it a revenue source, but it also preserves banks' cost advantage to move money. It's a second of many more bank-exclusive services.

I wish I could simplify for you the full set of bank-exclusive services here in the US, but history hasn't been so kind. National banks are different from state banks and federal savings associations. Don't even get me started on federal thrifts or the recently invented National Chartered Trust Companies. It's a veritable alphabet soup of bank types, each of which is regulated in ever so slightly different ways.

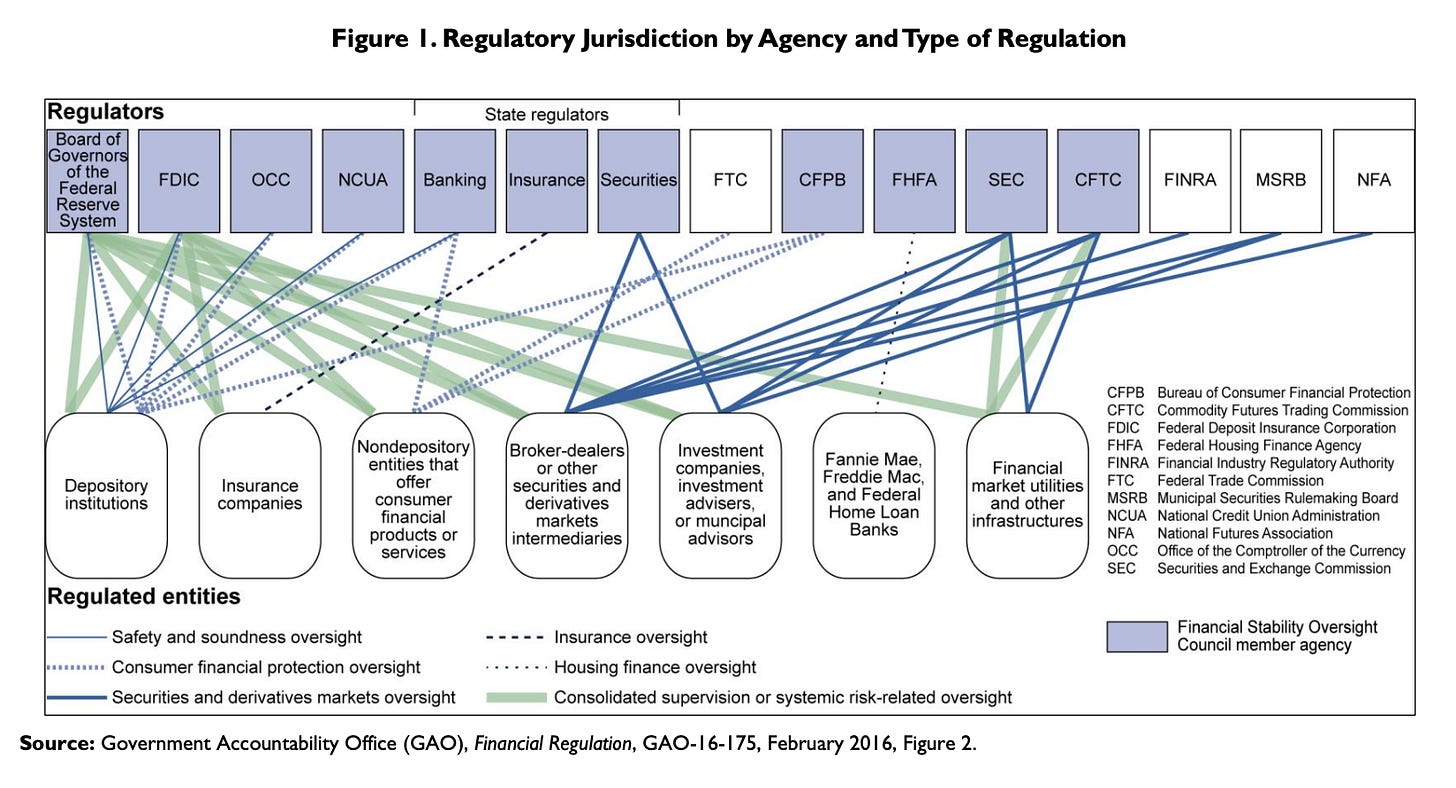

It's all a result of how we got here. There was never a master plan for banks in the US. Banking predates the Constitution and remained the exclusive regulatory purview of states until 1864.2 The National Banking Act didn't so much as take that power away as it did overlay additional federal level regulators. The result is a morass of regulators with a spaghetti mess of relationships of who regulates whom and for which activities.

Year by year, the regulators engage in turf wars and ever so slightly modify constitutes a bank. Congress jumps in every generation or so and upends huge swaths of the system.

It's atypical. Most countries have a single bank regulator and banks can offer a large variety of services including insurance and brokerage that US banks cannot. Most of these divisions are artifacts of regulations passed in the post-Depression era. Few other countries did the same.

What remains universally the same - in the US and globally - is government guarantees.

Modern banking is built on the premise that ordinary citizens can store their money at a bank and get it back. It's a government guarantee.

In the US, the primary guarantee is implemented via the Federal Deposit Insurance Corporation. The FDIC levees a fee on all member organizations that offer FDIC-insured deposits. Those fees create an insurance fund that insures the deposits. Entirely member funded with seemingly no burden on the taxpayer.

The US government nonetheless backstops FDIC insurance. In the event the fund was to ever run dry, taxpayers would be left holding the bag. The existence of the backstop naturally deters its use - depositors trust they'll get their money back. In times when the survival of the banking sector has been suspect, Congress has preemptively bailed out banks before the FDIC funds could ever run dry. The result is that the FDIC has remained privately funded.

Similar guarantees exist globally, including the CDIC in Canada and Financial Services Compensation Scheme in the UK. They all suffer from the same problem - moral hazard.

A bank can make short-term additional profits taking on additional risks like lending against inadequate capital or making loans unlikely to be paid back in a recession. In the absence of a government guarantee, the bank would have to eat the full cost of any money it loses long-term. With a government guarantee, the bank can offload some of the losses on the taxpayer. Heads the bank makes more profit, tails the taxpayer picks up the bill.

We've solved for moral hazard in part with additional capital requirements - banks now hold a lot more cash and cash equivalents compared to the loans they extend than they did in 2008, and likely more than they have at any point in US history. But for the biggest banks, that's not good enough. We've layered another implicit guarantee.

In the wake of the Great Financial Crisis, we created a new designation for those companies deemed too big to fail: Systemically Important Financial Institutions (SIFIs). Each country designates which of its domestic companies meet the SIFI threshold. Those that do are required to hold even more cash and cash equivalents to absorb potential losses. In theory, the new designation de-risks the system.

But by formally designating banks as too big to fail, we've implicitly declared that we'll bail them out no matter what the cost. If you're the bank, why bother being careful with how you lend if the taxpayer will pick up the bill? If you're the customer, why worry if the bank is risky if you know they'll be saved?

In attempting to de-risk banking, we’ve reintroduced even more moral hazard.

It’s also created a mostly fat and happy industry. The regulations written to prevent blowups are a barrier to entry for newcomers and a cost burden for existing banks. They're a meaningful driver behind industry consolidation, why half the banks in the US have disappeared over the last 20 years. The guarantees we made to protect consumers have solidified the position of the biggest banks, the ones least motivated to innovate.

What we're talking about is stagnation. For any faults one may take with the Free Banking Era, no one would deny the extraordinary experimentation that went on. It's all but lost today.

30 years after Netscape and two decades after the dot-com crash, banks finally have almost useable websites. A couple even have mobile apps where you can do ordinary banking activities.

But peek behind the webpage and you'll find the same creaky infrastructure that's been there for decades. Innovation in the core is scant at best. The majority of banks surveyed by Cornerstone haven’t even deployed cloud! AWS launched 20 years ago!

But why bother? Most of the 4000+ banks in the US are small, local, community banks. The baker on Main Street will take out a mortgage for the bakery and the farmer on the outskirts will borrow to buy feed. They'll go to the local bank because they don't have anywhere else to go.

I'm sure there are examples where local banks abuse their mini-monopolies as the only game in town, but I doubt that's representative of more than a handful. Most local bank owners are prominent members of their communities and that's not the reputation they want. The challenge is that innovating won't grow the town to create more business for the bank - technology is an expense that doesn't grow the business.

That is, until recently.

Most banks might not have gone digital, but it never had to be most. It only ever had to be a handful.

The internet breaks down barriers to distribution. The availability of an app on a phone means that a local bank no longer has a monopoly on small deposits - they're competing against everyone who gets installed on the phone. The ubiquity of websites that compare loan rates means the local bank's now competing with the whole country to underwrite a mortgage.

The fat and happy mini-monopolies are over. Competition is rearing its head and not everyone will survive.

We could talk about how deploying software in the cloud can lower costs for a bank and increase the velocity at which they can experiment. We could talk about how banks like JP Morgan are at an advantage because they can invest huge sums of money in engineering teams that small community banks cannot. There are exciting stories like that of Column who is building new bank technology from the ground up and Mode Eleven who is working with a core banking technology partner to do the same.

But that's next week's topic.

First, we have to understand why this shift to digital is so impactful, why this is the primary driver of bank consolidation. It all comes down to channels.

Digital has given ways to APIs as the seventh wave of banking. Michael Dowling of Mode Eleven described it brilliantly on Funders & Founders (emphasis mine):

At the end of the day, how have banks have evolved? A lot of the evolution is not by regulations, not by money management, not even the technology used to record money. None of that has really been a change at banks. What has been changing are the channels of interaction.

So leading all the way up until the eighties and nineties, it was the branch. The branch was your interface to the bank. Then ATM's kind of came into play. Then debit card. And online banking and et cetera, et cetera, et cetera.

Our interface for Mode Eleven is APIs. That's it, plain and simple. We provide our fintechs easy APIs to create financial services. We take care of the operational pieces and the compliance pieces. Let the innovators do what they're really good at.

It begs repeating: let the innovators do what they're really good at.

APIs are a new way to think about what a bank can be. Don't try to compete with a sexy iPhone app - some Silicon Valley startup will win that battle every time. Don't force users to treat your bank as take-it-or-leave-it across all of your services - you might be competitive as a mortgage lender but you might not have that high-yield savings account the user's looking for.

Instead - unbundle the bank.

Surface each of the bank's core services as a standalone API that innovative startups can package into their services. Want to compete trying to offer the best new credit card? Great. You’ll be on of the 100+ startups trying the same thing, all white labeling the same bank-issued card. The banks wins no matter which startups succeed. Do you want the card but not the deposit account? That's fine - someone else will want the opposite. The bank wins again.

APIs are the new channel to the consumer. APIs to fintechs to consumers.

It's a wonderfully powerful model. Mode Eleven, Column, Evolve, and the other API-first banks can focus on their core competencies. They can make them available as services and leave app building, distribution, customer services, and many other messy concerns to others better suited to do so. The bank wins, the innovative startups win, and ultimately the consumer wins.

As I’ve lamented before, this will almost inevitably lead to the closing of many small banks that provide invaluable services to their local communities. But for some, the banks who start down this path soon, it may not have to be that way.

Mode Eleven is the holding company for Summit National Bank, a critical town pillar in Salmon, Idaho; Ekalaka, Montana; and Hulett, Wyoming. The total population of those three towns is less than 4000 people. Summit’s in many ways the only bank in town. With Mode Eleven, they’re poised to grow. Mode Eleven is investing in the bank and has committed to regulators to continue to do so. Mode Eleven's success is Summit's success, and ultimately the local communities' success.

It's a model that brings us all the way back to what a bank actually is. APIs as the channel keeps banking within the bank and leaves the rest to someone else. It's banking distilled down to its very essence: deposits, lending, regulatory compliance, and risk management.

It's a model even the Medici could understand.

A network of satellites blanketing the globe to provide communications anytime, anyplace. I thought Elon Musk's Starlink was the first real, commercial attempt until I learned about Teledesic. Tren Griffin joined as employee #4 in 1994 and tells the story of the rise and fall of the startup. From unabashedly ambitious beginnings with Craig McCaw and Bill Gates as founders to the eventual liquidation seven years later and after a billion dollars raised, Tren's story is a wealth of insights about startup life, risk management, and aligning partner incentives. (25iq)

We don't spend much time thinking about the dirt beneath our feet, but maybe it's time that changed. Plants release up to 40% of the sugars they produce into the surrounding soil. We're just beginning to understand why. More species-rich than any coral reef and more dynamic than any rainforest, soil has tremendous secrets still to unlock. Secrets that will be key to feeding humanity in the decades to come. Thanks to Refind for highlighting. (The Guardian)

I'm inherently suspicious of most performance metrics. There's an element of drawing the bullseye around the arrow that invariably creeps in. Seth Levine, a venture capitalist at Foundry Group, calls out IRR for its problems and how it can be manipulated. Treat this not as advice to abandon IRR as a return metric, but rather as education to understand how it can be useful and what are the shortcomings. Thanks to Farnam Street for highlighting. (VC Adventure)

Why pepperoni curls - a scientific exploration of the question no one was asking. I can't help but get excited about articles like this. There's so much to our everyday world we still don't yet fully understand, even something as trivial as to why pepperoni curls atop a pizza. The answer is more profound than you might expect, involving heat distribution, moisture retention, and "the fluid dynamics of stuffing." (Serious Eats)

Just three ingredients in this summertime classic

2.0oz Aged Rum

1.0oz Lime Juice

0.5oz Coconut Sugar Syrup

Pour everything into a shaker. Add ice until it covers the liquid. Shake for ~20 seconds, until the outside of the shaker is frosted. Strain into a glass and enjoy!

Traveling’s no excuse not to have a decent drink. I’m with family for the long weekend and don’t have my normal bar and glassware, but the evening very much called for a drink. Traditional daiquiris (white rum, lime, simple syrup) are great, but I prefer the caramel notes of aged rums and molasses-heavy sugars more. This strikes that perfect balance where the lime is still tart enough to cut through the summer evening but dirtier notes give the drink depth. It’s a staple for me that’ll make many more appearances as the temperatures rise.

Cheers,

Jared

I highly recommend The Richest Man Who Ever Lived to learn more about Fugger. Besides his rather amusing name, his story is extraordinary. At the time of his death, his wealth was equal to ~2% of Europe’s GDP.

A bit of handwaving here. There were no less than three attempts to create a nationally chartered bank (singular) prior to 1864. None of the proposals considered a multitude of nationally chartered banks (plural). Interstate banking doesn’t formally happen until the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, although workarounds were already so well established that the legislation was more a recognition of how the banking worked than it was meaningful in permitting such activities for the first time.